Driving Better

Participant Outcomes

A patent-pending new asset class

Explore Target Date Funds with Lifetime Income Builder

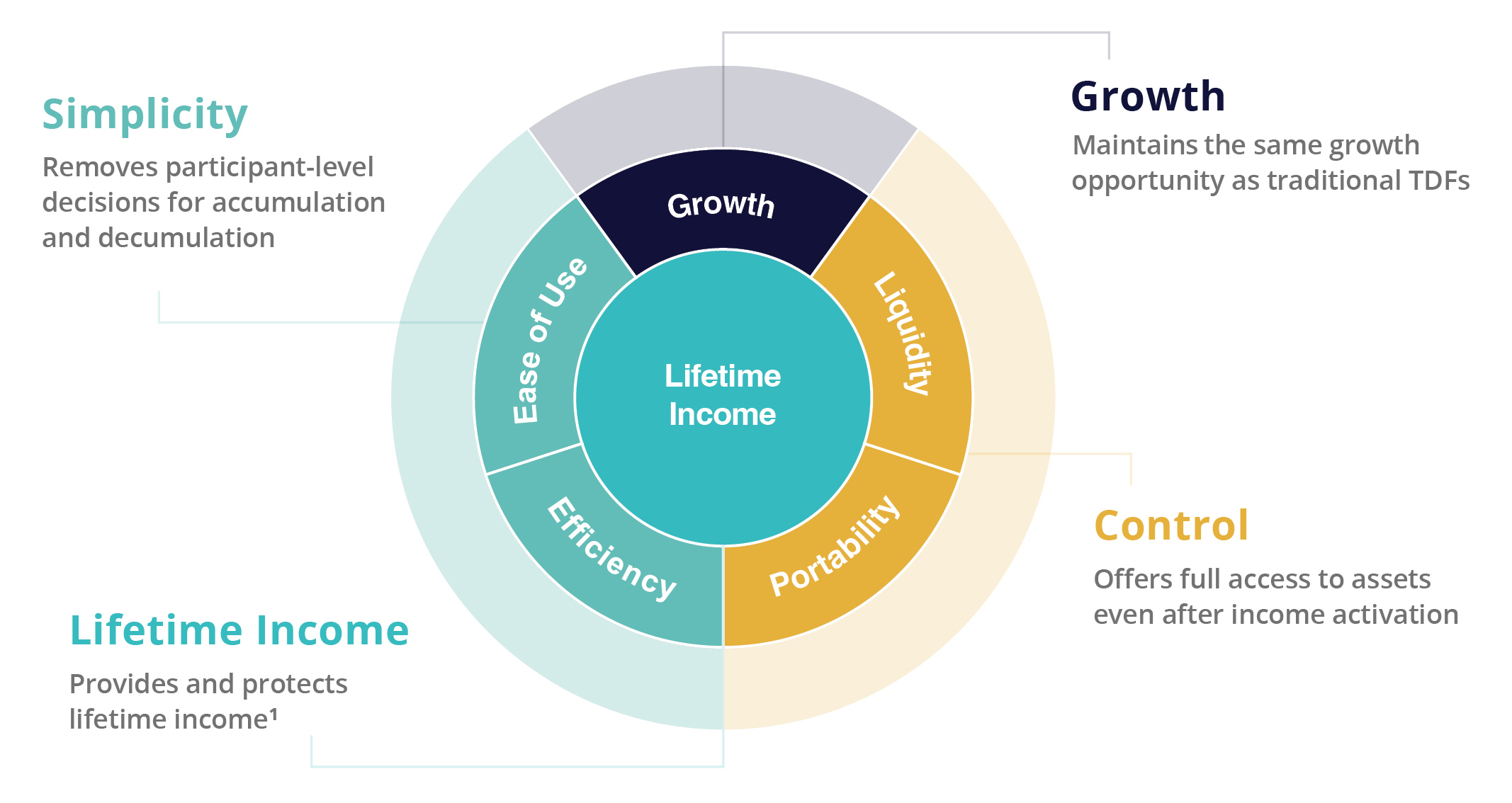

Simply stated, a target date fund (TDF) with Lifetime Income Builder offers more features than a typical target date fund. Our patent-pending design embeds Lifetime Income Builder directly into the portfolio, helping preserve the growth, liquidity, and control participants expect. Starting with a fixed indexed annuity (FIA) chassis that includes a guaranteed lifetime withdrawal benefit (GLWB), Lifetime Income Builder was engineered to function like any other investment, and in the process created a new investment asset class.

Suite of Retirement Income Solutions

Our solutions are available on over 60 recordkeeping platforms, including Nationwide® and Transamerica.

See the full list of recordkeepers available through iJoin here.

NCIT American Funds Lifetime Income Builder Target Date Series

This solution offers the same benefits as a traditional TDF, along with the following advantages:

State Street GTC Retirement Income Builder

This innovative solution provides participants with the core benefits of a traditional TDF, including a simple and automatic experience, full control of their assets, and professional investment management. But it offers much more, including:

Each target date fund in the series is established by Global Trust Company and held in the GTC Retirement Income Builder Collective Investment Trust (the “Trust”). The Trust is a bank-sponsored collective investment trust and not a mutual fund. Global Trust Company serves as trustee of the Trust, manages the Trust, and has ultimate investment authority for each fund in the Series. State Street Global Advisors manages a portion of the solution’s underlying assets and provides Global Trust Company with glidepath recommendations for the funds within the Series.

Coming soon…

Our third target date series with Lifetime Income Builder is launching in 2025.

APP Powered by Dimensional and

State Street GTC Retirement Income Builder

This Automated Personalized Portfolio (APP) offers a tailored approach to retirement planning, featuring portfolio recommendations generated by proprietary technology from LeafHouse, a 3(38) fiduciary. The portfolio components combine an innovative lifetime income solution from State Street Global Advisors and Global Trust Company with additional growth opportunities from Dimensional Fund Advisors. The solution provides participants with:

NCIT American Funds Lifetime Income Builder Target Date Series

This solution offers the same benefits as a traditional TDF, along with the following advantages:

State Street GTC Retirement Income Builder

This innovative solution provides participants with the core benefits of a traditional TDF, including a simple and automatic experience, full control of their assets, and professional investment management. But it offers much more, including:

Each target date fund in the series is established by Global Trust Company and held in the GTC Retirement Income Builder Collective Investment Trust (the “Trust”). The Trust is a bank-sponsored collective investment trust and not a mutual fund. Global Trust Company serves as trustee of the Trust, manages the Trust, and has ultimate investment authority for each fund in the Series. State Street Global Advisors manages a portion of the solution’s underlying assets and provides Global Trust Company with glidepath recommendations for the funds within the Series.

Coming soon…

Our third target date series with Lifetime Income Builder is launching in 2025.

APP Powered by Dimensional and

State Street GTC Retirement Income Builder

This Automated Personalized Portfolio (APP) offers a tailored approach to retirement planning, featuring portfolio recommendations generated by proprietary technology from LeafHouse, a 3(38) fiduciary. The portfolio components combine an innovative lifetime income solution from State Street Global Advisors and Global Trust Company with additional growth opportunities from Dimensional Fund Advisors. The solution provides participants with:

Partnering for Better Outcomes

ARS has forged strategic partnerships with some of the industry’s top-rated carriers, largest investment managers and leading plan administrators to align and protect best interests, leverage interdisciplinary synergies, and deliver stronger value across the board. By engaging all stakeholders up front in the process, we’re empowered to develop and deliver solutions that offer greater efficiencies and competitive advantages for every member of the defined contribution (DC) plan value chain.

Partnering for Better Outcomes

ARS has forged strategic partnerships with some of the industry’s top-rated carriers, largest investment managers and leading plan administrators to align and protect best interests, leverage interdisciplinary synergies, and deliver stronger value across the board. By engaging all stakeholders up front in the process, we’re empowered to develop and deliver solutions that offer greater efficiencies and competitive advantages for every member of the defined contribution (DC) plan value chain.

What can we do for you?

Whether you are a representative from a financial institution or a financial professional looking to offer your clients innovative solutions, we look forward to helping you. Contact us today to learn how you can leverage ARS to help build a more secure financial future.

Subject to the claims-paying ability of the insurance company.

1Starting at around age 50.

2The term “paycheck” as used here symbolizes a steady flow of income from this investment option throughout retirement. It does not refer to a conventional employer-issued paycheck and is not paid by any employer. Participants must stay invested in the investment option to receive lifetime income.

3The per unit value of the fund is measured on the last business day of each calendar quarter and the last business day of the month prior to income activation, and then the highest measured value is locked in. The high-water mark is not measured until the fund begins to allocate to the fixed indexed annuity.

46% and 4.5% are targeted percentages and there is no assurance that the funds will be able to make payments that meet either targeted percentage. Actual percentages may vary. See detailed disclaimers at the end of this webpage regarding actual percentages.

Patent Pending

This website is intended for institutional retirement industry professionals.

• Not a deposit • Not FDIC or NCUSIF insured • Not guaranteed by the institution • Not insured by any federal government agency • May lose value

Investing involves risk including the risk of loss of principal. Such activities may not be suitable for everyone.

Each target date fund (“TDF”) in a series is established by a trustee (the “Trustee”) and held in a collective investment trust (the “Trust”). The Trust is a bank-sponsored collective investment trust and not a mutual fund. Different series for the TDFs have been established by the Trustee and operate differently. The Trustee manages the Trust and has ultimate investment authority for each TDF in the applicable series. The Trust is exempt from registration under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended. Because the Trust is not registered with or required to file prospectuses or registration statements with the SEC or any other regulatory body, neither one is available. Investors should consult the Offering Memorandum for the applicable series and carefully consider the investment objectives, risk, charges, and expenses of the TDFs in that series before investing. Investors should further consult the Offering Memorandum for the applicable series to understand how the TDFs provide lifetime income, including whether a certain amount of lifetime income is guaranteed or not, how the income payment percentages at income activation are set, whether a joint income option is offered, and if so, how election of that option impacts income payments, how the high-water mark is set, and other important details regarding the operation of the TDFs in the applicable series.

“Lifetime Income Builder” is a group fixed indexed annuity with a guaranteed lifetime withdrawal benefit (a “FIA”). Each TDF may invest in more than one FIA. Advantage Retirement Solutions, LLC (“ARS”) is the inventor of the Lifetime Income Builder concept. Lifetime Income Builder is not provided by or guaranteed by the Trustee, ARS or any of their affiliates.

The TDFs invest in FIAs that are intended to back the Trust’s investment objectives, lifetime income. Each FIA is issued by an insurance company to the Trustee. The FIAs provide guaranteed payments to the Trust and are subject to the claims-paying ability of the issuing insurance companies. If the value of the other investments in the TDFs reaches zero at or after income activation, income payments are adjusted as detailed in the applicable Offering Memorandum.

The TDFs are designed for investors expected to retire around the year indicated in each TDF’s name. When choosing whether to invest in the TDF for which an investor age qualifies, investors should consider whether they anticipate retiring significantly earlier or later than age 65 even if such investors retire on or near a TDF’s target date. There may be other considerations relevant to determining whether investment in the TDF best meets their individual circumstances and investment goals. The TDF’s asset allocation strategy becomes increasingly conservative as it approaches the target date and beyond. The investment risks of each TDF change over time as its asset allocation changes.

An investment in a TDF is not a bank deposit and is not insured or guaranteed by the insurance companies, the trustee, the asset manager, the Federal Deposit Insurance Corporation (“FDIC”), or any other government agency. The Trust is not insured by the FDIC and is not registered with the Securities and Exchange Commission.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security or a product, or a recommendation of the suitability of any investment strategy for a particular investor. It does not take into account any investor’s particular objectives, strategies, tax status or investment horizon.

All information is from ARS (except where noted otherwise) or has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied or transmitted without ARS’s express written consent.

The entities reflected here have collaborated together to bring this solution to market; none of the collaborating listed entities are affiliated entities.