Lifetime Income

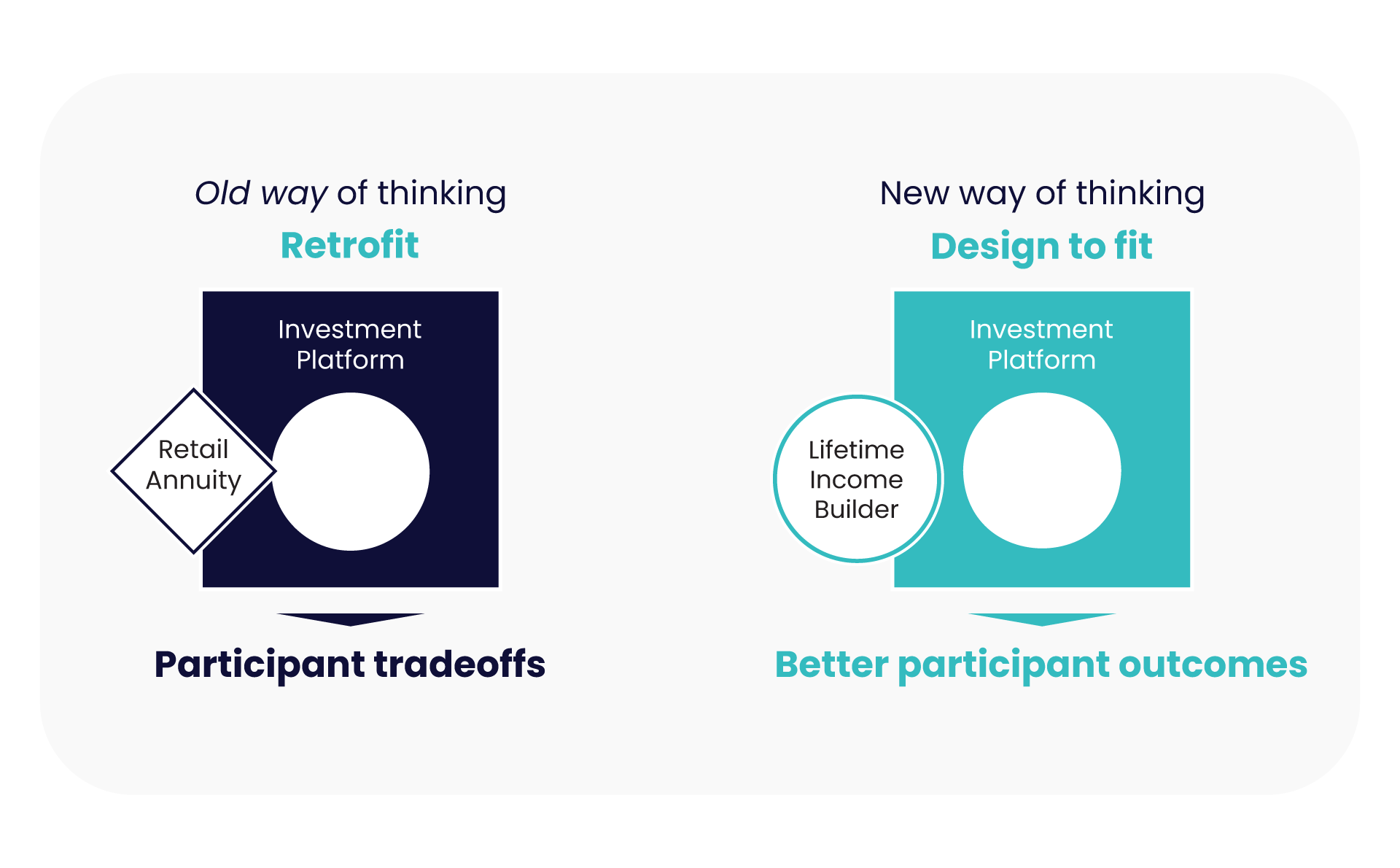

Designed to Fit, Not Retrofit

Discover a new type of investment built around participant needs

Innovative Income without Tradeoffs

Most retirement income products retrofit existing annuity products onto institutional platforms, which creates major inefficiencies and tradeoffs for participants. We’ve introduced true innovation through product design with a lifetime income product built to serve participants with growth opportunity and the flexibility of an institutional target date fund.

Patent Pending

This website is intended for institutional retirement industry professionals.

• Not a deposit • Not FDIC or NCUSIF insured • Not guaranteed by the institution • Not insured by any federal government agency • May lose value

This material is not a recommendation to buy, sell, hold, or roll over any asset, adopt a financial strategy, or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person.

Lifetime Income Builder will be powered by an insured guaranteed income solution issued by an insurance carrier that the plan fiduciary has determined qualifies for the safe harbor provisions of ERISA section 404. All guarantees and protections are subject to the claims-paying ability of the issuing insurance carrier. Lifetime Income Builder does not directly participate in the stock market or any index. It is not possible to invest in an index. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% federal tax penalty.

Investing involves risk including the risk of loss of principal. Such activities may not be suitable for everyone.

Each target date fund (“TDF”) in a series is established by a trustee (the “Trustee”) and held in a collective investment trust (the “Trust”). The Trust is a bank-sponsored collective investment trust and not a mutual fund. Different series for the TDFs have been established by the Trustee and operate differently. The Trustee manages the Trust and has ultimate investment authority for each TDF in the applicable series. The Trust is exempt from registration under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended. Because the Trust is not registered with or required to file prospectuses or registration statements with the SEC or any other regulatory body, neither one is available. Investors should consult the Offering Memorandum for the applicable series and carefully consider the investment objectives, risk, charges, and expenses of the TDFs in that series before investing. Investors should further consult the Offering Memorandum for the applicable series to understand how the TDFs provide lifetime income, including whether a certain amount of lifetime income is guaranteed or not, how the income payment percentages at income activation are set, whether a joint income option is offered, and if so, how election of that option impacts income payments, how the high-water mark is set, and other important details regarding the operation of the TDFs in the applicable series.

“Lifetime Income Builder” is a group fixed indexed annuity with a guaranteed lifetime withdrawal benefit (a “FIA”). Each TDF may invest in more than one FIA. Advantage Retirement Solutions, LLC (“ARS”) is the inventor of Lifetime Income Builder. Lifetime Income Builder is not provided by or guaranteed by the Trustee, ARS or any of their affiliates.

The TDFs invest in FIAs that are intended to back the Trust’s investment objectives, lifetime income. Each FIA is issued by an insurance company to the Trustee. The FIAs provide guaranteed payments to the Trust and are subject to the claims-paying ability of the issuing insurance companies. The FIA guarantees are not made to the participants, and participants are not beneficiaries of any annuity contract. If the value of the other investments in the TDFs reaches zero at or after income activation, income payments are adjusted as detailed in the applicable Offering Memorandum.

The TDFs are designed for investors expected to retire around the year indicated in each TDF’s name. When choosing whether to invest in the TDF for which an investor age qualifies, investors should consider whether they anticipate retiring significantly earlier or later than age 65 even if such investors retire on or near a TDF’s target date. There may be other considerations relevant to determining whether investment in the TDF best meets their individual circumstances and investment goals. The TDF’s asset allocation strategy becomes increasingly conservative as it approaches the target date and beyond. The investment risks of each TDF change over time as its asset allocation changes.

An investment in a TDF is not a bank deposit and is not insured or guaranteed by the insurance companies, the trustee, the asset manager, the Federal Deposit Insurance Corporation (“FDIC”), or any other government agency. The Trust is not insured by the FDIC and is not registered with the Securities and Exchange Commission.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security or a product, or a recommendation of the suitability of any investment strategy for a particular investor. It does not take into account any investor’s particular objectives, strategies, tax status or investment horizon.

All information is from ARS (except where noted otherwise) or has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied or transmitted without ARS’s express written consent.