This website is intended for institutional retirement industry professionals only.

Offer an Investment That Lasts a Lifetime

Participants want the ease of investing that comes with a target date fund (TDF) in addition to a viable solution for lifetime income. Discover a new kind of investment that can meet their needs.

Where Growth Opportunity Meets Simplicity and Security

The innovative new State Street GTC Retirement Income Builder Series provides participants with the core benefits of a traditional TDF, including a simple and automatic experience, full control of their assets, and professional investment management.

But it offers much more, including the opportunity for lifetime income and other key benefits including:

ADDITIONAL GROWTH OPPORTUNITIES

Growth potential through a bond alternative that maintains equity exposure and offers better returns in many economic environments.

QUARTERLY HIGH-WATER

MARKS

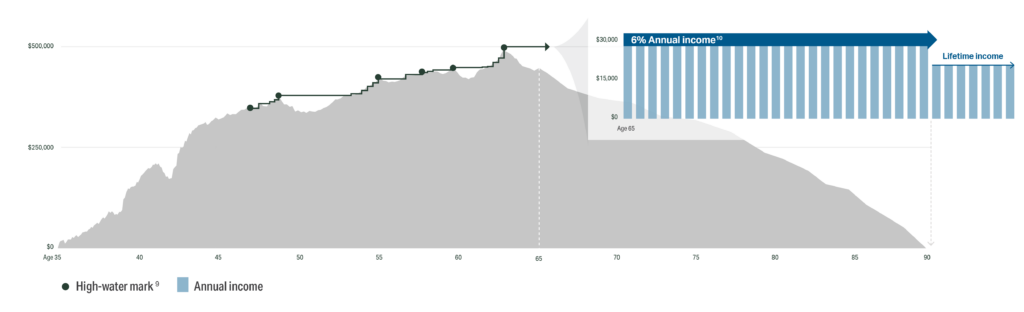

Quarterly high-water marks (HWM) on the entire account value locks-in future income values, helping mitigate sequence of returns risk. 1

6% ANNUAL

INCOME

6% annual income targeted and based on the greatest HWM, plus the opportunity for lifetime income to help eliminate longevity risk. 2

A Simplified Participant Experience

Participants need a means to achieve income for life without sacrificing growth or control of their investment. With the State Street GTC Retirement Income Builder, they receive a professionally managed solution that turns their portfolio into a steady paycheck for life — and protects them against market volatility and outliving their money.

A Target Date Fund Designed for All Stages of Life

Standardized

With an automatic experience, participants benefit from a hands-off investment experience from the moment they invest in the TDF. Similar to traditional TDFs, the glidepath invests more heavily in equities at first and gradually adjusts to reduce exposure.

Customized

As participants enter their prime earning years, they are also most susceptible to sequence of returns risk and market volatility. The TDF helps mitigate these concerns by capturing HWMs to lock in any potential future lifetime income, starting around age 47.

Personalized

Participants will automatically receive a monthly payment, starting at the target date, but can decide if income is the best option for them at that time. They also can reinvest, defer payments, or take a lump sum of their assets.

Innovation And How To Deliver Greater Lifetime Value

This paper explores the insightful findings from CANNEX’s latest research, “Comparing a Novel In-Plan Income Solution to Alternatives”.

What can we do for you?

Whether you are a representative from a financial institution or a financial professional looking to offer your clients innovative solutions, we look forward to helping you. Contact us today to learn how our solutions can help you build a more secure financial future for participants.

1 The per unit value of the fund is measured on the last business day of each calendar quarter and the last business day of the month prior to income activation, and then the highest measured value is locked in. The high-water mark is not measured until the fund begins to allocate to the fixed indexed annuity.

2 6% is a targeted percentage and there is no assurance that the funds will be able to make payments that meet the targeted percentage. Actual percentage may vary. See disclosures below regarding actual percentages.

3 “Retire that thinking: Uncovering better strategies for retirement readiness,” Capital Group, March 2021.

Subject to the claims-paying ability of the issuing insurance companies.

Patent Pending

This website is intended for institutional retirement industry professionals

Investing involves risk including the risk of loss of principal. Such activities may not be suitable for everyone.

Each target date fund in the series is established by Global Trust Company and held in the GTC Retirement Income Builder Collective Investment Trust (the “Trust”). The Trust is a bank-sponsored collective investment trust and not a mutual fund. Global Trust Company serves as trustee of the Trust, manages the Trust, and has ultimate investment authority for each fund in the Series. State Street Global Advisors manages a portion of the solution’s underlying assets and provides Global Trust Company with glidepath recommendations for the funds within the Series.

Lifetime Income Builder is a group fixed indexed annuity with a guaranteed lifetime withdrawal benefit (a “FIA”). Each TDF may invest in more than one FIA, collectively which are referred to throughout this presentation as “Lifetime Income Builder.” Advantage Retirement Solutions, LLC is the inventor of Lifetime Income Builder. The FIA guarantees are made to the trustee of the TDF, not to the participants. Participants are not beneficiaries of any annuity contract. Lifetime Income Builder is not provided by or guaranteed by Global Trust Company, State Street Global Advisors, Advantage Retirement Solutions, LLC or any of their affiliates.

Each fund is designed to provide participants target annual income of 6% at income activation and a target minimum lifetime income percentage of 4.5%. The target percentages are goals and there is no assurance that the funds will be able to make payments that meet either target percentage. All income payments to participants, regardless of the percentage, are always dependent on the trustee.

The funds invest in FIAs that are intended to back the Trust’s investment objectives, lifetime income. Each FIA is issued by an insurance company to the trustee. The FIAs provide guaranteed payments to the Trust and are subject to the claims-paying ability of the issuing insurance companies. If the value of the non-FIA investments in the fund reaches zero at or after income activation, income payments are adjusted to the cumulative guaranteed percentage provided to the Trust by the FIAs, which is targeted by the trustee of the fund to be the target minimum lifetime income percentage of 4.5%. The actual annual income percentage and actual minimum lifetime income percentage are dependent on economic factors and may be more or less than what is targeted. There are possible, but extreme, market conditions where the FIAs’ cumulative guaranteed percentage that is provided to the Trust could be less than 4.5%. Therefore, we use the term “target minimum lifetime income percentage” to properly reflect the potential for such scenario. In that scenario, the FIAs would still provide guaranteed payments to the Trust, but it would be something less than the targeted minimum of 4.5%, and payment of income to the participants would remain dependent on the trustee.

If a participant selects the joint income option offered by the fund, the actual payment percentages will be less than 6% and 4.5%, but instead of income payments terminating upon the death of the participant, income payments will continue to be made to the joint beneficiary if the joint beneficiary outlives the participant.

Current target annual income and target minimum lifetime income percentages reflect economic conditions at the time each fund is created. Future funds in the series could have lower or higher targeted percentages based on economic conditions at the time of the fund’s creation. Please refer to the Offering Memorandum for more information on the risks of not receiving income payments.

The funds are designed for investors expecting a stream of income around the year indicated in each fund’s name. When choosing whether to invest in the fund for which an investor’s age qualifies, investors should consider whether they anticipate a need for an income stream significantly earlier or later than age 65. There may be other considerations relevant to determining whether investment in the fund best meets their individual circumstances and investment goals. The funds’ asset allocation strategy becomes increasingly conservative as it approaches the target date and beyond. The investment risks of each fund change over time as its asset allocation changes.

An investment in a fund is not a bank deposit and is not insured or guaranteed by the insurance companies, the trustee, State Street Global Advisors, the Federal Deposit Insurance Corporation (“FDIC”), or any other government agency. The Trust is not insured by the FDIC and is not registered with the Securities and Exchange Commission.

Each FIA is issued by an insurance company to the trustee. The FIAs do not create any third-party beneficiary relationships or third-party beneficiary rights for any other person or entity. The insurers do not guarantee that participants will receive lifetime income.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security or a product, or a recommendation of the suitability of any investment strategy for a particular investor. It does not take into account any investor’s particular objectives, strategies, tax status or investment horizon.

State Street Global Advisors makes no representation or warranty as to the current accuracy, reliability or completeness of the information contained herein and assumes no liability for decisions based on such information. Further, third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to use of such data.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

The entities reflected here have collaborated together to bring this solution to market; none of the collaborating listed entities are affiliated entities.

© 2025 State Street Corporation.

All Rights Reserved.

Information Classification: General Access

5888852.5.1.AM.INST

Exp. Date: 5/31/2026